With the ever-changing financial markets, it becomes necessary to regulate it somehow. The European Union solved this problem by creating an integration initiative called the Single Euro Payments Area (SEPA). It was also supported by other European countries outside the EU, such as Iceland, Liechtenstein, Norway, Switzerland, and Great Britain. One of its main achievements was the designing and implementation the Payment Services Directive (PSD). It aims to foster European competition in the payments sector, encouraging participation from traditional banks and non-bank entities. It was achieved by harmonising regulations related to consumer protection and clearly defining the rights and responsibilities of both payment service providers and users.

However, the financial environment doesn’t stand still either technologically or socially. It was necessary to align it with the demands of the times. That’s why the Payment Services Directive was improved to the second version, the Revised Payment Services Directive or PSD 2. It modernised and made more secure payment services across the EU and the European Economic Area. If you want to comply with the requirements of PSD 2 and will prepare for PSD 3 coming soon, contact Crossbill.

PSD1 vs PSD2

PSD 2 was a big step forward compared with the previous version. Business owners need to comprehend the differences between them and learn what’s new in PSD 2.

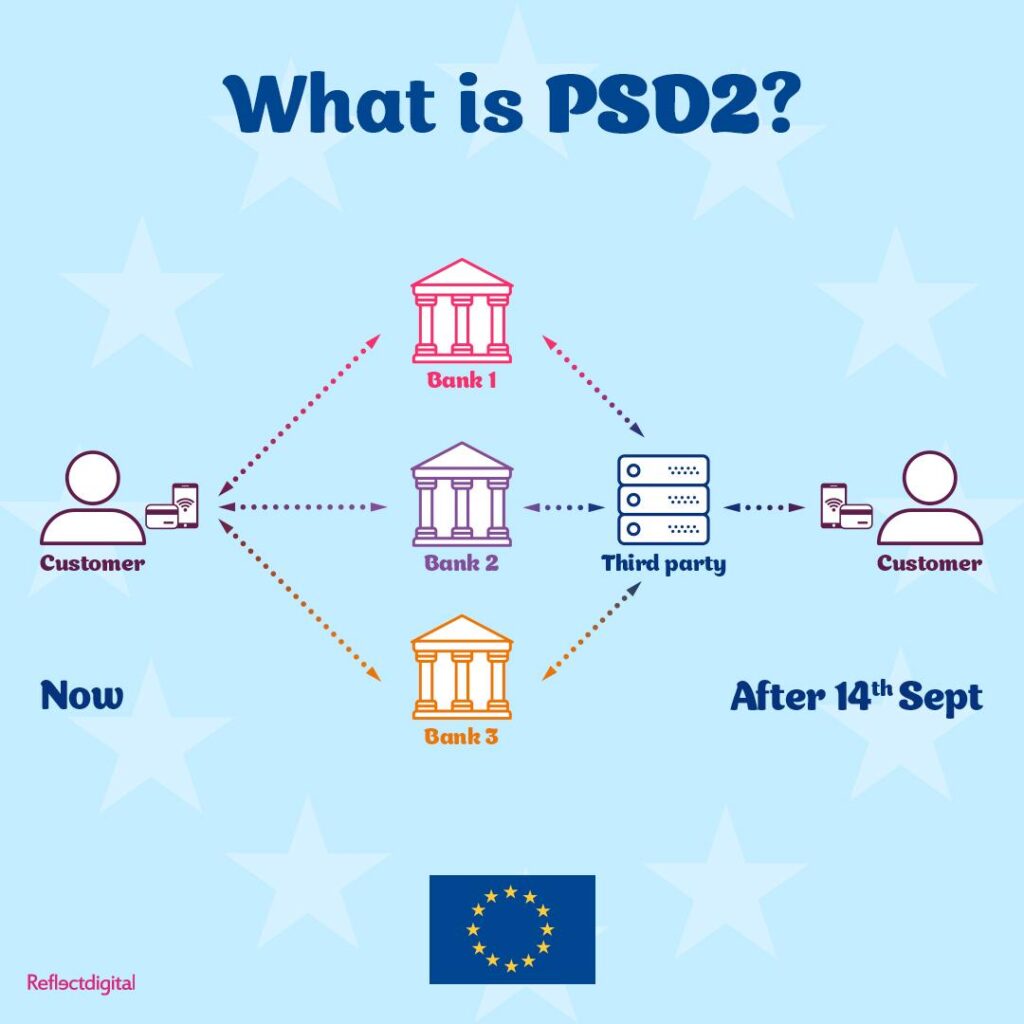

- Focus. While PSD 1 mainly considered traditional banks and payment institutions and their competition, PSD 2 included third-party providers (TPPs), such as account information service providers (AISPs) and payment initiation service providers (PISPs). PSD 1 also paid little attention to technological advancements, which changed in the second version.

- Third-party access. Only PSD 2 started to ensure secure APIs for TPPs to access customer data (with their consent).

- Security requirements. While PSD 1 had general protections for consumers and payments, PSD 2 implied Strong Customer Authentication (SCA) and stricter rules on fraud.

- Geographical prevalence. PSD 1 was applied to payment transactions within the EU, and PSD 2 covers all payments where one party is in the EU, even if the other is outside.

- Transparency of fees. As PSD 1 left room for ambiguity, PSD 2 enhanced this situation, including banning surcharges for card-based payments within the European Union.

- Innovative services. PSD 2 encourages fintech innovation by regulating TPPs and enabling open banking, which was missing in the previous version.

Benefits of PSD2

Considering the weaknesses of PSD 1, PSD 2 gives more opportunities for customers and businesses. Among them are the following:

- Enhanced protection. As we wrote before, PSD 2 grants SCA, because of which online transactions must be verified using at least two independent factors from three categories. They are something that a client has (for instance, a smartphone), knows ( a PIN code), or is (an eye scan).

- Increased competition and innovation. PSD 2 allows third-party providers (TPPs) to access bank data with customer consent, fostering a more competitive environment. It boosted competition between banking and non-banking structures, which are made to impress their customers, trying to draw their attention.

- Improved user experience. PSD2 facilitates open banking so users can enjoy a more seamless banking experience. Other new features aim to make transactions quicker and smoother, that also positively influences clients’ overall impression.

As the first Payment Services Directive became slightly outdated, it was upgraded to the second version. It has many changes compared to its predecessor and contributes to more security, enhanced competitiveness, and user experience.