With the appearance and spreading of the Internet, online retailing is snowballing, even in remote corners of our planet. Offline stores still account for approximately 80% of all retail sales, but this ratio changes yearly towards the Internet market. Therefore, a company that pays more attention to this sphere, investing its time, money, and human resources, gets more impressive profits. Payment orchestration aims to support this purpose by boosting your online market performance.

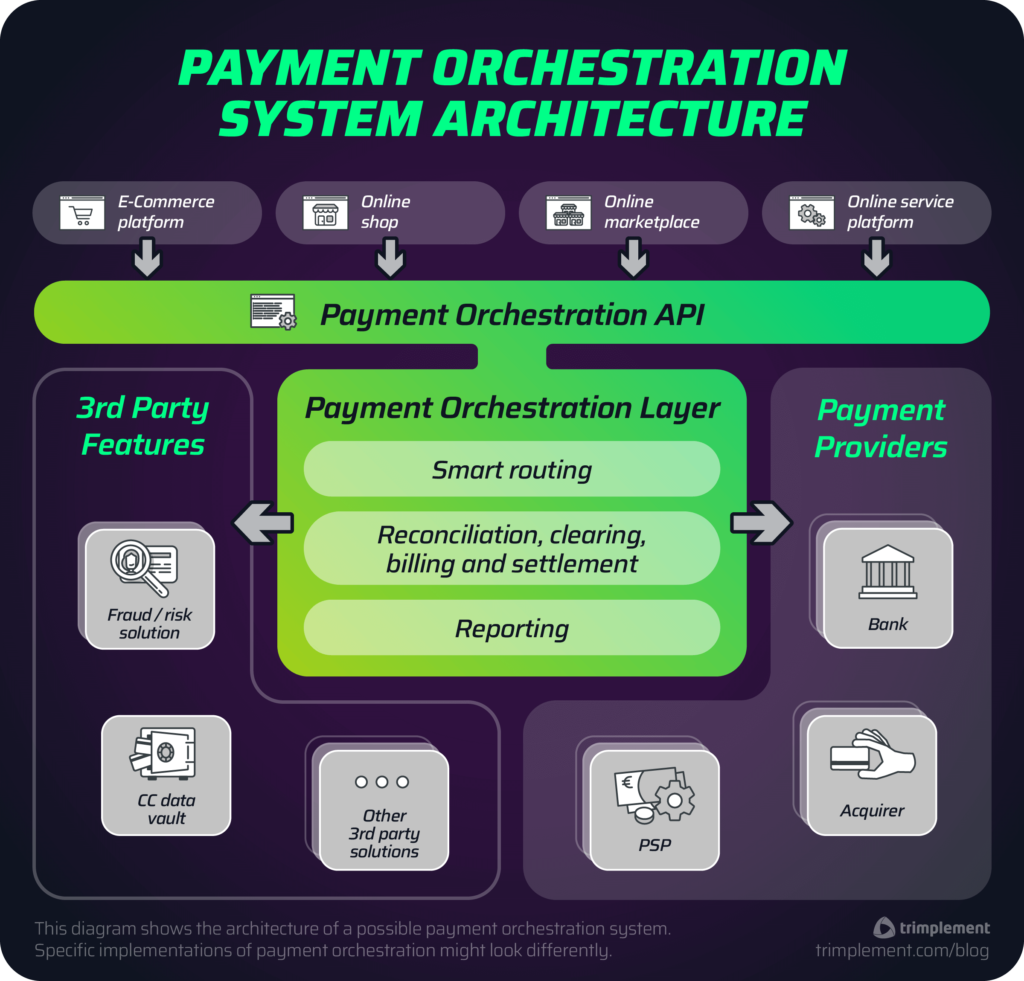

Payment orchestration is a system that provides online payment management by integrating multiple payment service providers, gateways, and other related services through a single platform. Such an online, single, cohesive transaction structure empowers enterprises to enhance their operational agility and accelerate their growth trajectory. Crossbill helps you implement a payment orchestration platform (POP) to boost your business routine if you want to increase your financial income.

Benefits of Payment Orchestration

Payment orchestration is a reliable and proven way to make your revenues bigger. But with its implementation, you can achieve multiple goals:

- Improved conversion rates. As a centralised system, payment orchestration reroutes failed transactions to alternative payment providers in real time. This feature reduces the number of transaction failures and decreases the risk of customers going to your competitors.

- Cost optimisation. With local peculiarities of digital payment habits worldwide, the transaction landscape is uneven. Still, it offers various possibilities for saving money, playing on differences in bank policies and social factors in different countries. POP automatically chooses the most cost-effective payment gateway or processor based on transaction type, location, or currency.

- Better user satisfaction. Payment orchestration ensures that transactions meet clients’ expectations. With its help, they become safer, smoother, and quicker. POPs also consider region-specific payment methods, giving customers the opportunity to use local payment methods they prefer.

- Simplified management. One monolith platform is obviously much more accessible to administer and control than many payment service providers, gateways, etc., simultaneously. With POP, businesses accomplish their expansion goals more easily and effectively. It also provides enterprises with detailed analytics on transaction performance.

- Enhanced security and compliance. Payment orchestration integrates advanced fraud detection tools and helps companies adhere to global and regional financial regulations.

How Does Payment Orchestration Work?

From Payment Orchestration benefits, let’s go to a step-by-step breakdown of how it operates:

- A client picks up goods or services.

- Then, they choose a payment method and enter their payment details into the designated fields.

- Encryption of the sensitive card details using advanced encryption protocols.

- The encrypted payment information is then transmitted to the acquiring bank via the payment processor. Upon receiving the transaction data, the acquiring bank contacts the issuing bank to verify the transaction’s authenticity.

- After verification, the issuing bank sends back an authorisation response – either approving or declining the transaction- along with a response code indicating the outcome. Here is where payment orchestration distinguishes itself from traditional payment processing methods. If a transaction is declined, rather than simply notifying the merchant of failure, the payment orchestration platform automatically reroutes the same payment request to an alternative payment processor.

- Final approval of the transaction.

With the increasing volume of internet sales, companies should focus on their digital possibilities to support them. Payment orchestration is a perfect solution to organise and manage the whole online payment process, and Crosbill can implement it.