Attempting to predict the future and follow plans is crucial to any business. It’s vitally important for owners to monitor trends, particularly in the digital payment ecosystem. People pay much attention to transactions’ safety, speed, and smoothness, so payment development will follow these directions.

Making transactions even more fast, smooth, and secure

Indeed, technologies will continue to be upgraded and influence payment solutions. Companies that manage to implement them in their work will have a strategic advantage in competition. The same goes for the payment process. It’s an integral part of the user’s experience, so a client may return to you if it’s fast and safe. Some customers today even refuse to purchase a product if the payment can’t be made in a few clicks. Therefore, businesses should care about it to increase their profits.

However, progress will be achieved only with the active introduction of the latest technologies. Among them are artificial intelligence and machine learning systems, which appeared relatively recently but have already made payments quicker, safer, and more personalised. They help prevent fraud attacks, collect data, and even communicate with clients 24/7, and they will become increasingly effective.

Enhancement of alternative payment ways

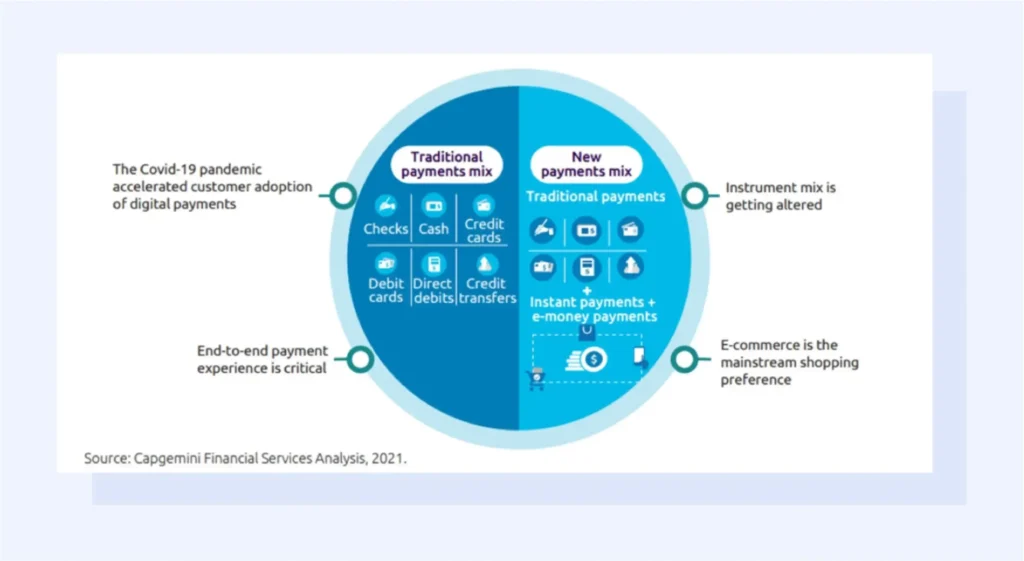

Credit cards aren’t the only way to make transactions. We can see this trend today, and doubtlessly, it will continue to gain momentum. Large social media companies offer payment possibilities through their social networking services. Different accessories with internet access, like smartwatches, also provide an opportunity to pay online. More and more devices will surely include transaction possibilities to simplify customer life. It can be household appliances and so on.

Other transaction trends

There are many more directions in the payment industry which play or will play more significant roles:

- the rule of who controls the data controls the world will be increasingly relevant, so that the improvement of ways of its collecting will be even more vitally important than now;

- smartphones will continue to corner e-commerce, and various specific payment solutions like QR codes will be more for them;

- international transactions will develop, this sphere will grow;

- banks will promote cooperation with fintechs for mutual benefit;

- blockchain and cryptocurrencies will continue to be an alternative to traditional payment ways.

Companies will stay focused on protecting a customer’s data and money, usability, and speed of transactions. In order to remain competitive, they should follow the newest technology trends and promptly implement them in the payment process.