Payment gateway (PG) and payment processor (PP) are terms commonly unknown to people who make transactions. However, they play a significant role in digital payment processes. They work together to provide safe, fast, and reliable transactions both for clients and businesses. It can be helpful for entrepreneurs to comprehend the difference between PG and PP and learn their functions.

What are a payment gateway and a payment processor?

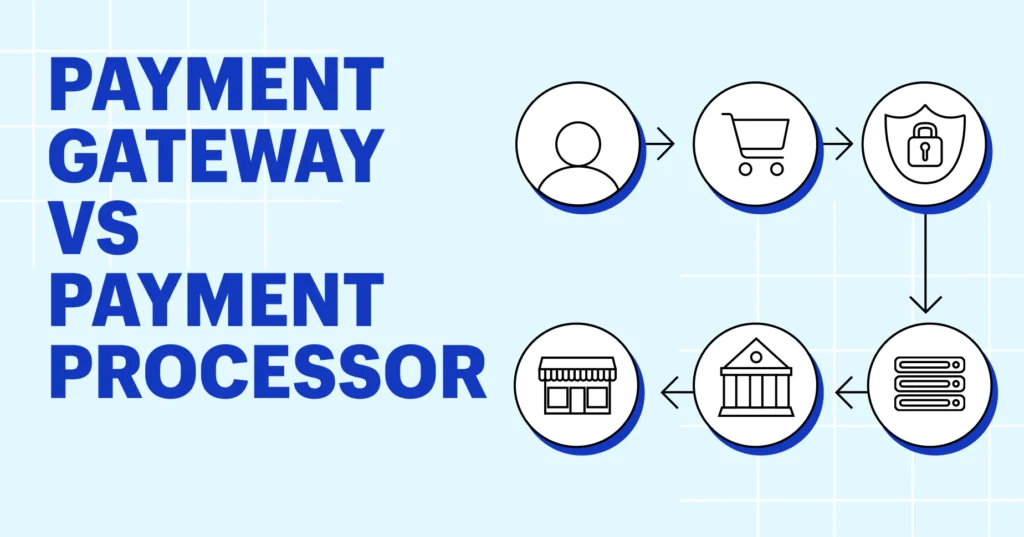

A payment gateway is a service which securely accompanies transactions from money senders through banks to recipients. It receives card details, encrypts them for safety, and transmits them to an acquiring bank for further processing. A payment gateway is integral to any online store business because it enables digital payments. It supports different payment methods like cards, e-wallets, and bank transfers and makes transactions really fast.

A payment processor is a system that enables the whole transaction procedure. It takes card details from the PG and sends a request to an issuing bank to make sure a card is valid and has enough money. Then, depending on an answer, the PP confirms or rejects a transaction and reports about it to a sender. A payment processor will be especially vital for businesses with huge payments or intention to become international.

What’s the difference between a payment gateway and a payment processor?

A payment gateway and a payment processor aim at one goal: to make a transaction successful, so they look similar. But actually, they’re not the same and have the following differences:

- they work in separate ways: PG collects and transmits card details, whereas PP connects all transaction participants in the payment process;

- PG is used mainly for digital transactions; PP can make both online and offline payments;

- payment gateway ensures the transfer of payment data from a client to an acquiring bank; a payment processor provides the transfer of funds to a seller;

- the gateway secures the data at the stage of collection and transmission of payment information, and the processor’s protection is activated when a transaction has already been transferred to a bank.

A payment gateway and a payment processor are critical actors in fund transactions. They can perform separately but most often work together. Nevertheless, businesses should distinguish them, as well as their functions and modus operandi. This way, they may choose and implement the most profitable strategy.