With the technological development of humanity, the financial system kept improving. It went from natural exchange to complicated monetary ecosystems and cashless digital transactions. But payment solutions improvement wasn’t going to stop. Springing up like mushrooms after the rain, alternative payment methods seriously pushed the classic financial transaction ways. And this tendency will only persist because alternatives are fast and low in costs. It’s really beneficial to anyone to know these alternative methods and how to use them.

Shortly speaking, alternative payment methods are any transactions that are made without cash or a credit card. Their history and development are integrally connected to the internet and, therefore, started in the 90s. Another significant milestone in expanding alternative payment methods was the emergence and spread of relatively cheap mobile internet connections. It boosted the rapid growth of mobile commerce and, consequently, mobile payments.

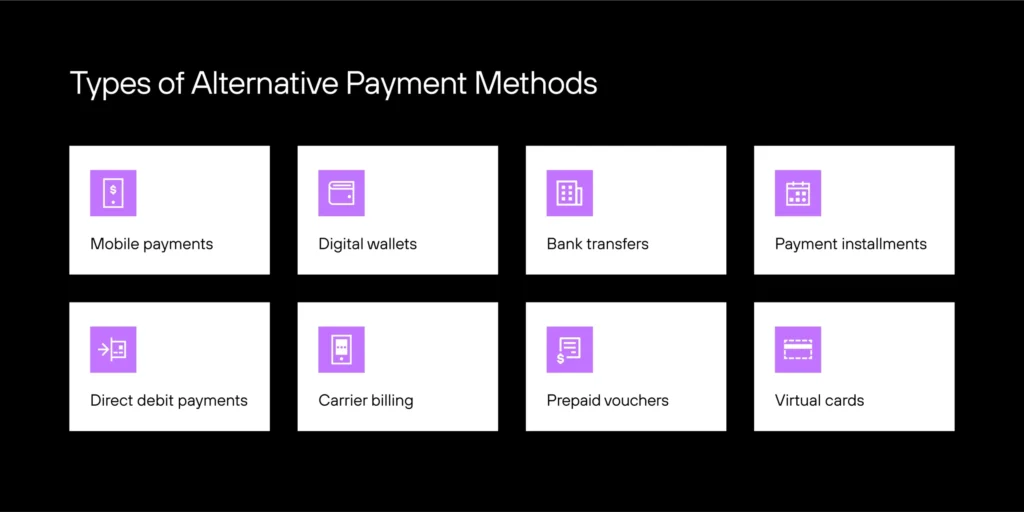

Types of alternative payment methods

Alternative payment methods can be divided into several tiers. Let’s look at them:

- Direct debit payments. The most famous example is monthly payments on the subscription base for using YouTube, Apple Music, etc. Such companies collect money directly from customers’ accounts, bypassing credit and debit cards.

- Bank transfers. It’s a convenient way to buy something online without going to a brick-and-mortar bank. Money goes directly to the merchant’s account.

- Mobile payments. It’s probably the most popular alternative payment method, successfully competing with cash and card transactions on its own, and it will continue to grow. How could it not, if, with a smartphone, everybody can make any transactions at any time of day or night?

- Payment instalments. They give the possibility to get products now and pay later on a set schedule with smaller payments.

- Е-wallets. These electronic applications or programs work as credit or debit cards but online. Examples include Apple Pay, PayPal, and others.

- Virtual cards. Digital versions of traditional cards.

- Prepaid vouchers. These coupons can be purchased in advance for a certain amount of money and used to pay for goods and services.

- Carrier billing. It’s when money for purchases is withdrawn from your mobile bill.

With the rapid development, our ideas about money are constantly changing. Several decades ago, bank cards seemed to be technological perfection, but now you can arrange your apartment by lying in bed with your smartphone. Knowing the alternative payment methods is helpful for customers and businesses. Especially for the last ones, they can attract clients with unusual but comfortable payment ways.